BY KARISSA MILLER

Iredell County commissioners, representatives of Iredell-Statesville Schools, the Mooresville Graded School District, Mitchell Community College and Our Schools First held a kick-off meeting on Tuesday to build support for the upcoming school bond referendum.

I-SS, MGSD and Mitchell boards have approved resolutions in support of ballot measures to finance $125 million in school construction projects. The referenda will be on the March 3 ballot.

Iredell commissioners voted unanimously in December to put the referenda on the primary ballot following a two-and-a-half-year study by the Iredell County Education Facilities Task Force.

The school bond projects include an $80 million high school in the southern end of the county for I-SS, a $35 million middle school for Mooresville Graded School District and $10 million for a new public safety training facility and instructional pad for driving for Mitchell Community College.

Voters will be asked on March 3 to grant the county the borrowing authority for the bonds.

The first question on the ballot is the K-12 education bond, which totals $115 million for I-SS and MGSD. The second question is the community college bond, which proposes $10 million for Mitchell Community College.

Voting Dates

• Jan. 13: Absentee voting starts.

• Feb. 7: Voter registration deadline for March 3 primary.

• Feb. 13: Early-one stop voting begins.

• Feb. 29: Early-one stop voting ends.

• March 3: Primary Election Day

Our Schools First helping lead pro-bond campaign

During Tuesday’s kick-off event, Our Schools First (OS1) invited community leaders to learn more about the need for the two new schools, which is driven by recent and future growth in the southern end of the county.

Organizers pointed out that their aim is to provide potential voters with information needed to make an educated decision.

“We’re officially the mouthpiece of the school bond referendum. The superintendents and president can say to the community vote yes to the bond referendum. Staff at the schools are only allowed to do that on downtime, in their own personal time,” OS1 President Beth Packman explained at the meeting at the Career Academy and Technical School in Troutman.

OS1 was instrumental in the passage of the 2014 school bond, which promoted a variety of projects across the county, which have also benefited the greater community.

Packman said she would love to speak to local civic groups and parent teacher organizations about the importance of supporting the 2020 school bond referenda, which she considers to be the best use of tax dollars.

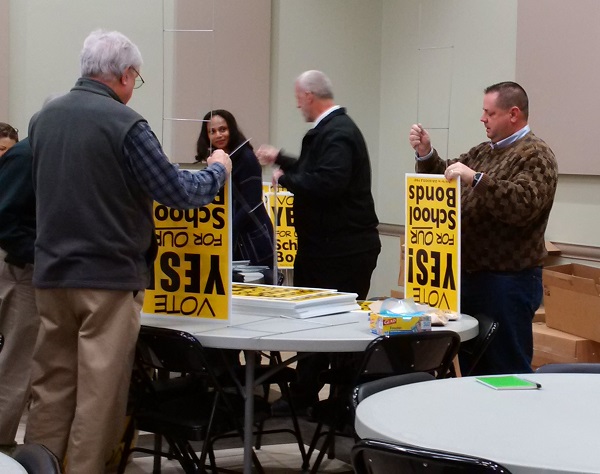

OS1 has purchased lawn signs, stickers, car magnets and a flyer. The group is continuing to raise money to support the pro-bond effort.

Why now?

According to county officials, 11,000 new homes in the southern end of the county are either under review or in the early stages of development.

Based on housing unit development maps, many of the new homes planned will be located in Troutman and Mooresville.

School officials are concerned because many of the schools in the southern end of the county are already at or near capacity, and the housing development will further drive up school enrollment.

Iredell County Board of Commissioners Chairman James Mallory called the bond a “capacity only bond.”

What will it cost?

Nobody wants to pay higher taxes, but the school bond funds will help the county address a growth and school crowding issue from Troutman to the southern county line, Packman explained.

“For those who live north of Troutman, this bond has long-term benefits for every school in the county, not just the southern end where the housing growth is located,” she added.

Furthermore, Iredell County has seen a 13.88 percent increase in population from 2010 to 2020. In other words, the tax base has expanded and it will not cost as much per household this time around.

The 2014 bond required a tax increase of about 4.25 cents in the property tax rate, Packman said. “This bond will only cost a penny per $100 tax valuation,” she emphasized.

To better understand the impact, a home valued at $100,000 would see a tax increase of about $10 per year, or about 83 cents a month.

Maintaining a low tax rate

If the county property tax rate is increased by a penny to fund the repayment of the bonds, Iredell County would still have the lowest tax rate of any of the nine contiguous counties that border it. Currently, Iredell has the 13th lowest tax rate among the 100 counties in the state.

If approved, the county property tax rate would go from $0.5275 to $0.5375. The bordering counties tax rates are as follows:

• Alexander .790

• Wilkes .660

• Yadkin .660

• Davie .738

• Rowan .6575

• Cabarrus .740

• Mecklenburg .6169

• Lincoln .599

• Catawba .575